Search

Marsoft Market Update: Tanker & Dry Bulk Outlook for Early 2026

Marsoft’s latest market eBriefs show both the tanker and dry bulk sectors entering 2026 with solid momentum, shaped by a mix of supportive fundamentals and evolving geopolitical dynamics. While each market faces its own set of drivers, both share an early‑year strength that may moderate as supply and routing conditions shift later in the year. Tanker Market: Strong Fundamentals, Heightened Enforcement Environment Tanker markets begin 2026 on firmer footing, with early‑Janua

Jan 212 min read

Containership Report for Q4 published

December 15, 2025 Containership markets continued to capitalize on geopolitical turmoil in 2025. Despite the ongoing trade wars, containerized trade volumes gained significant ground. Charter rates and second-hand prices moved higher. Liner operators enjoyed another year of strong profits, although liner earnings were markedly lower than the year before. In November, leading carriers warned of likely losses in 25Q4 and in 26Q1. Will containership charter rates and vessel pric

Dec 15, 20251 min read

What’s Behind the Cape Rally? - new Marsoft Beat episode released

Capes above $40,000/day — what’s behind the breakout? In the latest episode of The Marsoft Beat , Kevin Hazel sits down with Ryan Uljua to unpack the remarkable rally in the largest dry bulk segment. They cover: ⚓ Brazilian long-haul iron ore strength 🌍 West Africa’s rising iron ore role...even before Simandou ramps up 🇨🇳 China’s “steel production down, iron ore imports up” paradox 📈 How 2025 has tracked along Marsoft’s early-year "High Case" scenario 🚢 Our latest re

Dec 8, 20251 min read

How long will elevated VLGC rates last?

December 5, 2025 By Megan Kennedy Spot rates for conventional VLGCs have started the last month of 2025 averaging more than 30% higher than rates in December of 2024. So far this month, VLGC rates have topped over $60,000 per day, and for Q4-to-date, conventional rates are averaging roughly $57,000 per day – some 40% higher than the same quarter last year. The fourth quarter is typically a lower-demand period for VLGCs, whereby Asian demand falls back after its Q3 seasonal

Dec 5, 20252 min read

VLCC Rates Surge - new Marsoft Beat episode released

VLCC spot rates have surged past $120,000/day, driven by OPEC supply, sanctions enforcement, and a sharp rise in oil on the water. In this episode of The Marsoft Beat, Ryan Uljua speaks with Marsoft Senior VP John Moulopoulos to break down what’s behind the spike and how long it’s likely to last. Drawing on Marsoft’s recent 25Q4 Tanker Market Report, they discuss the temporary drivers lifting earnings today, the impact of Red Sea normalization on tonne-mile demand, accelerati

Nov 26, 20251 min read

The Marsoft October eBriefs for Dry Bulk and Tanker markets are now available

Marsoft’s Dry Bulk market outlook for the remainder of the year is cautiously optimistic: improved grains trade prospects, steadier iron ore imports, and the recent seasonal rebound in Asian coal flows have prompted modest upward revisions to our base case relative to last August. Looking at 2026 however, China’s slowing import demand, firm fleet growth throughout the year and the expected Red Sea normalisation in 26H2 point to a gradually softening balance throughout 2026, w

Oct 20, 20251 min read

Marsoft’s outlook will be updated later this month in our Q32025 Release

Our team will shed light on the impact of all the pressing matters and uncertainty shipping is facing today: Red Sea diversions , OPEC ...

Aug 11, 20251 min read

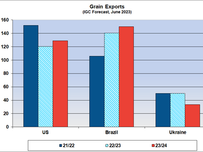

Kevin Hazel, a Partner at Marsoft, gives the latest Marsoft comment on Ukrainian Grain Exports

After peaking in the 2020/21 crop year at 580 million tonnes, the grain trade has now fallen over the past two years. The latest figures...

Jul 21, 20232 min read

Truths and Misconceptions – in the Aftermath of the Market Boom Cycle

Our 23Q1 Containership report is out now. Below, Costas Bardjis reflects on some of the key points from the report. Following two years...

Mar 27, 20235 min read

23Q1 LNGC and VLGC Reports Available

LNGC spot rates saw spectacular gains in October and November, with rates skyrocketing to more than $400,000 per day, before falling...

Mar 13, 20231 min read

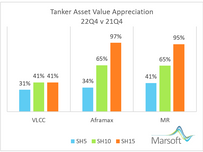

A Watershed Period for the Tanker Market

One year on from the start of the war in Ukraine, a lot has changed for the tanker market due to the significant role played by Russia in...

Mar 6, 20232 min read

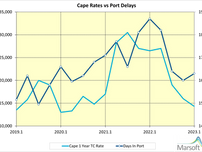

Port Delays and Dry Bulk Rates

A sharp drop in port delays, set against the backdrop of weak trade demand, was the key factor behind the swift retreat in dry bulk...

Mar 2, 20232 min read

LPG Rates Waning as We Enter 2023

VLGG spot rates, which soared to new highs above $125,000 per day in the fourth quarter of 2022 on the heels of stronger Asian and...

Jan 18, 20231 min read

A Tale of Two Halves

2022 was a tale of two halves for the dry bulk market, with a strong first half followed by a rapid retreat in the second half of the...

Jan 17, 20233 min read

2022 Review - Tankers

2022 was impacted by the fallout from the war in Europe, subsequent sanctions on Russian exports, China’s Covid policy, and OPEC+’s...

Jan 11, 20232 min read

Marsoft's 22Q3 Update

Things are changing fast in some of the major shipping sectors. Our quarterly reports discuss fundamentals in detail and provide...

Aug 23, 20222 min read

How does the Russia-Ukraine war affect European coal imports?

The Russian-Ukraine War is wreaking havoc on European energy markets, and while the oil and gas markets have drawn the most attention,...

Jul 7, 20222 min read

MARSOFT’S JUNE 2022 eBRIEFS now available

The June eBriefs examine the impact and key developments affecting the dry bulk and tanker markets arising from the impact of the...

Jul 3, 20221 min read

22Q2 Containership and Gas Market Reports are now available

Our Containership Market Brief looks at stormy weather ahead but is optimistic that the re-opening of the Chinese economy and the...

Jun 10, 20221 min read

22Q2 DRY BULK AND TANKER MARKET QUARTERLY REPORTS

Our 22Q2 Dry Bulk and Tanker reports are out now. The discussion includes: Sanctions against Russia already making a shift in trading...

May 26, 20221 min read